Crypto Futures Trading: Key Strategies for Consistent Profit

To anyone experienced in traditional finance markets, trading derivative products like futures is nothing new. In fact, they’ve been around since the 1800’s and are common in commodity markets like oil and gold.

It didn’t take long for the crypto market to adopt the idea when the Chicago Mercantile Exchange (CME) first introduced crypto futures trading in 2017. Now, hundreds of millions worth of crypto futures are traded every day, and traders employ various strategies to earn consistent profits.

If you’re new to futures, there’s a lot to unpack. From margin calls to swing trading, we’ll go through everything you need to know to build a profitable crypto futures trading strategy together.

What Is Crypto Futures Trading?

Trading crypto futures allows you to speculate or ‘bet’ on the future price of a cryptocurrency without owning the actual coin. It involves trading contracts, with a promise to buy or sell crypto at a locked-in future price.

Here’s a simple example of how crypto futures trading works:

Imagine the price of Bitcoin is $50,0000.

You think the price will rise to $60,000 in one month.

You could buy a Bitcoin futures contract to purchase Bitcoin at $50,000 in one month.

If the price rises to $60,000, you can buy the Bitcoin at $50,000 and immediately sell it for the spot market price of $60,000.

You’d pocket $10,000 profit (minus any fees).

But if you’re wrong and Bitcoin’s price falls to $40,000, you’re still required to buy it at $50,000, resulting in a $10,000 loss (plus any fees).

Benefits of Trading Crypto Futures

You might think, ‘Why don’t I just trade normal cryptocurrency’? Well, there are several advantages to trading crypto futures:

- Profit in any market: You can enjoy profits in any market – up or down. Take long positions if you believe prices will rise or a short position if you think prices will fall.

- Leverage: You can amplify smaller investments for increased potential gains, but the risk rises accordingly.

- Enhanced liquidity: The design of futures contracts makes them easier to enter and exit positions quickly.

- No asset storage: Gain exposure to crypto markets without holding the actual asset. This reduces the burden associated with safely storing coins

Risks Involved in Crypto Futures Trading

- Margin requirements: Your position will be liquidated if your account balance falls below the maintenance margin. You could lose your money if you can’t pay the contract fees.

- Volatility: Crypto is highly volatile, and rapid price swings trigger unexpected losses or gains.

- Amplified risks: Using leverage can quickly magnify losses. You could lose your initial position if the market moves against you.

- Regularity uncertainty: The legal structure for crypto derivatives is still being built in many jurisdictions. Changes in legislation could impact your trading ability and withdrawal of funds.

Getting Started with Crypto Futures Trading

To start crypto futures trading, you’ll need to select a trusted exchange to understand margin and leverage and set up your account.

Choosing the Right Exchange

When picking your trading exchanges, it is important to use platforms with trustworthy reputations and regulatory compliance. Before depositing any funds, do your research and investigate the history of an exchange.

In addition, exchanges with a wide range of future contracts and high liquidity ensure you have a wide choice and can easily enter/exit positions. Trading fees, user interface, and currency support should also be factored into your choice.

A good starting point to find an exchange is to look at the top crypto futures exchanges by volume. This includes industry leaders like Binance, Bybit, Bitfinex, and Kraken.

A bonus on these top crypto futures exchanges is the inclusion of a demo account. This is a ‘mock’ trading account to help you learn and practice trading without risking real money.

Understanding Leverage and Margin

Leverage lets you trade with more money than you actually have. It’s a way to boost your profits (or losses). Generally, leverage ranges from 2x to 100x. That means you could trade futures using 100 times your capital investment.

Trading crypto futures with leverage means you’re borrowing money from the exchange to increase your buying power. Margin is the collateral you need to open and maintain a leverage position. Think of it as your down payment. If a trade goes against you and your losses exceed your margin – the exchange will issue a margin call. You are required to add more funds to your account to maintain your position. If you can’t, the exchange closes your position at a loss.

Setting Up Your Trading Account

For beginner crypto investors, getting started will require setting up a trading account. This involves the completion of the exchange’s registration process. This usually involves KYC (know your customer) checks to confirm your identity.

Once verified, you can fund your account using either crypto or fiat currency. Check your exchange accepts your chosen deposit methods.

Essential Crypto Futures Trading Strategies

When trading crypto derivatives, various strategies and theories exist to take advantage of market movements while managing risk.

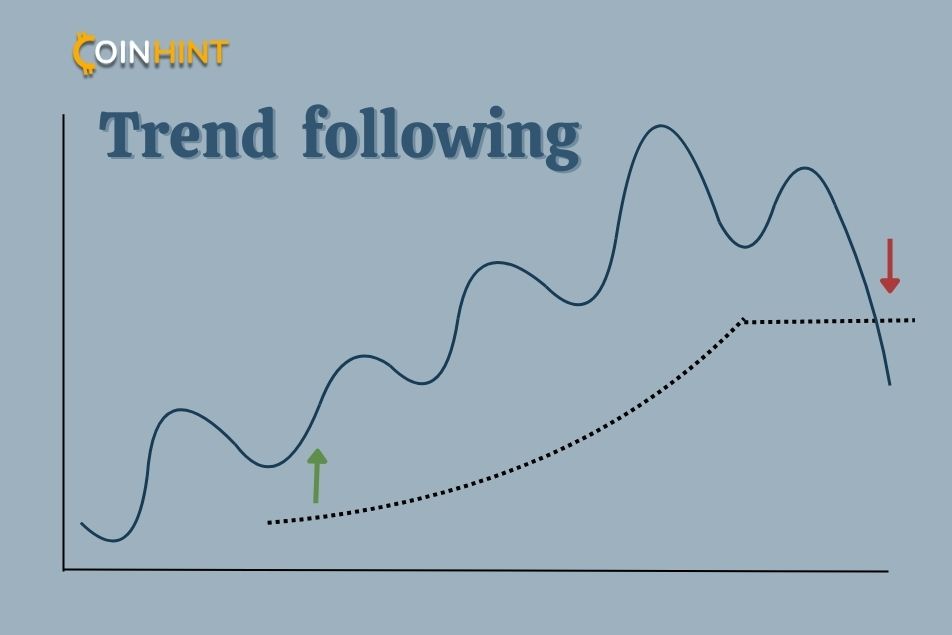

Trend Following Strategy

Trend following in crypto futures involves spotting and riding market trends. These are macro market movements over weeks, months, or years.

How to Identify Trends

The key to spotting a market trend is to look for sustained price movements in a particular direction over a given period.

Highs and lows: Identify price patterns, such as higher highs and higher lows, that signal an uptrend. Or lower lows and lower highs during a downtrend

Support and resistance: Certain price points act as barriers to market movements. As the market breaks through these levels, it can signal a changing trend. Prices moving through the support level often point to a downward trend. Breaking above a resistance level often signals an uptrend.

Trading volume: Monitoring trading volume can confirm trend strength. When volumes increase, it suggests strong market participation and a growing trend, while reducing volume points towards a weakening trend.

Wider sentiment: Related news and events can directly affect a market’s direction. Be sure to monitor the general market feeling and attitude.

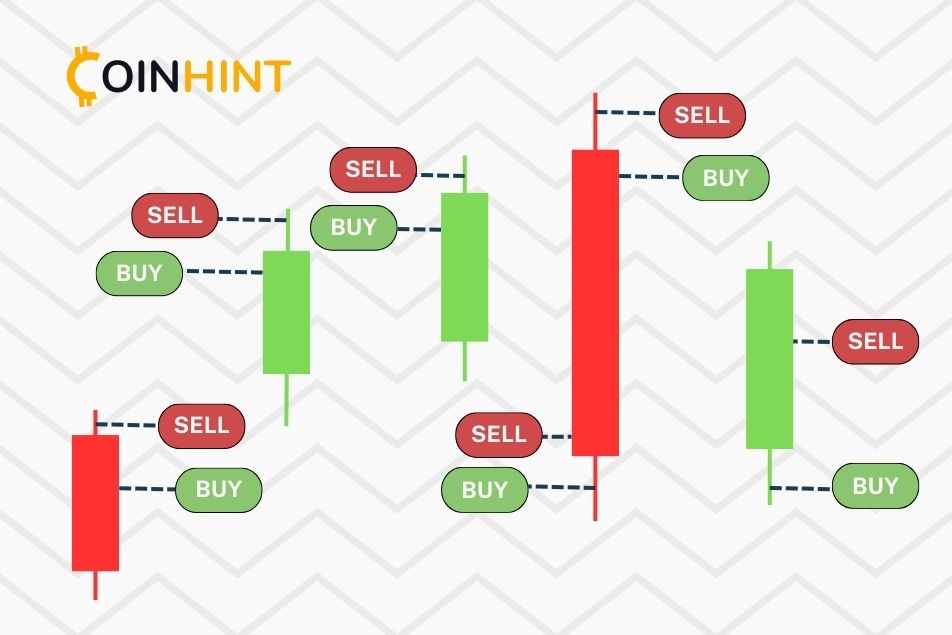

Tools for Trend Following

Candlestick charts: Candlestick charts are a simple visual way to spot patterns in price movements. A candlestick highlights price action over a particular timespan. The main ‘body’ shows the open and close price with ‘wicks’ showing the high and low price. Green candles signal uptrends, while red signal downtrends.

Relative Strength Index (RSI): The RSI is a momentum indicator showing the speed of price movements. It ranges between 0 and 100. A score above 70 is seen as overbought (a sign to sell) while below 30 is considered oversold (a signal to buy).

Moving Averages: The moving average is a constantly updated average price that smooths out price data. This presents several famous signals, including the ‘golden cross’ buy signal and the ‘death cross’ sell signal.

Scalping Strategy

What Is Scalping?

Scalping is a strategy for profiting from small price movements over very short timeframes. As a scalper, the aim is to make a high frequency of trades daily, each lasting minutes or seconds. The strategy needs fast decision-making and precise execution.

Techniques for Effective Scalping

To be an effective crypto scalper, you should focus on highly liquid futures contracts. These have tight spreads and speedy execution. Depth charts and order book analysis are popular ways to spot potential entry and exit points.

Profitable scalping relies on solid risk management – stop-losses and take-profit orders should be set for each trade.

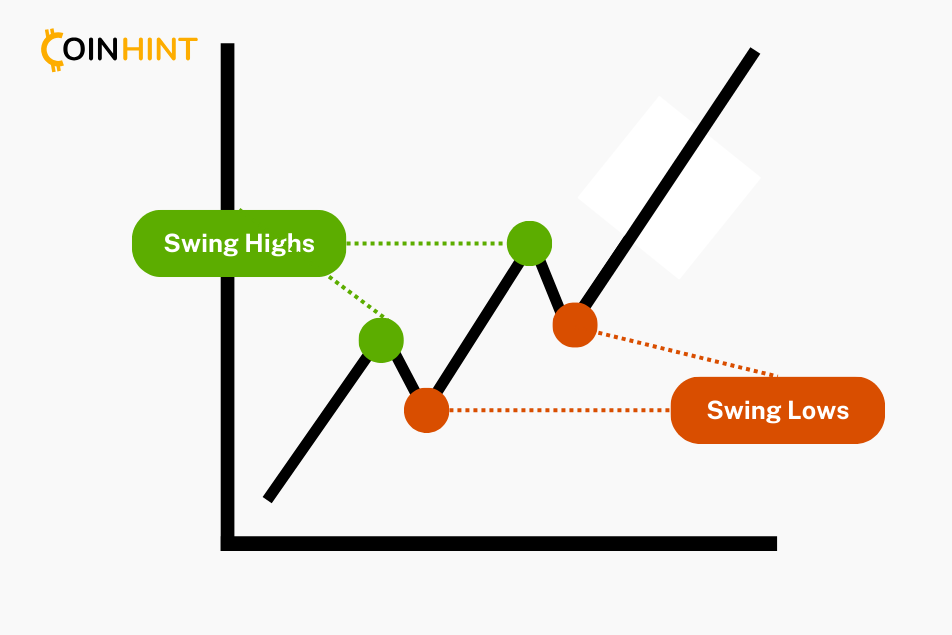

Swing Trading Strategy

Understanding Swing Trading

A swing trading strategy aims to profit from swings within larger market trends over days or weeks. Support and resistance levels are used to identify entry and exit points. Top swing traders rely heavily on technical analysis to build their strategy.

Key Indicators for Swing Trading

Fibonacci retracements and pivot points are the main tools used to predict price movements. Horizontal lines are added to charts to highlight likely support and resistance levels. This helps you pick your entry and exit points as prices approach these levels.

Arbitrage Strategy

Arbitrage in crypto futures involves finding anomalies in prices between markets and exchanges. The goal is simple: to buy low in one market and quickly sell high in another.

Types of Arbitrage

- Spot-futures: Profiting from price differences between a cryptos spot price and the futures price. If the future’s price is higher – buy the spot and sell futures. If the futures price is lower, sell the spot and buy futures.

- Inter-exchange: Differences in prices between exchanges enable you to buy the contract on one exchange and quickly sell it on another for profit.

- Calendar spread: If you can identify price differences on futures contracts with different expiry dates, you can buy the cheaper contract and sell the more expensive one.

- Funding rate: Perpetual futures never expire, so they have a ‘funding mechanism’. If a perpetual futures price is higher than the spot price, short the perpetual contract and long on the spot market to earn the funding rate.

How to Execute Arbitrage Trades

To implement arbitrage strategies, you need accounts on multiple exchanges and advanced trading tools. Speed is everything. Opportunities disappear quickly, and arbitrage traders help maintain consistent prices across the market. Many traders use automated systems and ‘bots’ to execute trade simultaneously.

Advanced Techniques in Crypto Futures Trading

You can significantly enhance your crypto futures results with advanced trading techniques. To keep an edge over the market, the best traders are always on the lookout for more sophisticated analysis, strategic advantages, and strong risk management.

Using Technical Analysis

Many traders swear by their special technical analysis methods. It enables them to identify movements in market prices that others don’t see. Common technical analysis tools include:

- Moving averages

- Relative strength index (RSI)

- Fibonacci retracements

- Bollinger bands

As you learn to trade, you’ll start to combine your favorite indicators to build your strategy. Backtesting your strategies and theories on historical data is a useful way to improve your approach.

Implementing Fundamental Analysis

Fundamental analysis is about understanding the outside forces that affect market prices. It is about understanding what’s happening in the world and predicting human behavior in the markets. When conducting fundamental analysis, you should include the following:

- Regulation changes

- Market adoption rates

- Macroeconomics

- Industry and global news

- Project developments

- General market sentiment

- Political agenda

Risk Management Strategies

Strong risk management helps to protect your capital, avoid catastrophic losses, and improve chances of long-term success. Key risk management strategies include:

- Using a stop loss to limit losses

- Set take-profit orders to lock in gains

- Diversify your trading positions

- Adjust leverage as the market condition require

Common Mistakes to Avoid in Crypto Futures Trading

It’s easy to make a mistake when trading crypto futures. Even experienced traders are known to slip up in such volatile markets. So, our CoinHint analysts have listed the most common mistakes to avoid:

- Overtrading: Making too many trades results in excessive fees and costs. Plus leads to emotional exhaustion and bad decision-making.

- No Stop-loss: Failing to use a stop-loss exposes you to sharp, unexpected downward market moves.

- Over-leveraging: This is a common pitfall for greedy traders. Using leverage dramatically amplifies any losses.

- Insufficient research: Making uninformed trades based on limited research often results in loss. Never base your strategies based on tips, whispers, or theories without doing your research and analysis.

Final Thoughts

Trading crypto futures offers the opportunity for significant profit, but there are risks too! It’s important to understand how derivatives work and build a solid strategy. Swing trading, arbitrage, scalping, and trend following are all well-tested profitable strategies when used correctly.

Educate yourself on the fundamentals of trading and practice on a mock account. Choose a reputable, trustworthy exchange to execute your trades. Plus, ensure you implement rigorous risk management to avoid massive losses.

FAQ

-

Is crypto futures trading profitable?

Yes, trading crypto futures can be profitable, but it carries significant risks. Profit depends on the trader’s skill, strategy, risk management, and market knowledge.

-

What is the best crypto futures trading strategy for beginners?

Beginners should start with paper trading. This involves using a mock account that doesn’t risk real money. You can then practice using leverage, stop-loss, and profit-taking. In addition, you can try out different trading strategies like swing trading or scalping.

-

How much capital do I need to start trading crypto futures?

Some exchange platforms let you start trading crypto cultures for as little as $10. You might want to start with a higher amount like $500 – $1000 to see any tangible gains after trading fees are accounted for.

-

What are the tax implications of crypto futures trading?

The tax on crypto futures trading varies by country. Often profits from regular futures trading are treated as income tax but it can also be classed as capital gains. Keep detailed records of all trades and consult a tax professional in your country.

-

How do I stay updated with the latest crypto market trends and news?

Keeping up to date with market trends and news is crucial for any successful trader. Read trustworthy news sources, join relevant online communities, and track real-time price and volume information. In addition, you can set up alerts for price movements or breaking news.