Crypto Cards Explained: What They Are and How They Work

Crypto credit cards are changing how people use their digital currencies by making spending cryptocurrencies like Bitcoin and Ethereum easier in everyday purchases. These cards allow users to transact just like a regular credit card while enjoying the extra benefits of crypto rewards. This article will examine how these credit cards work, the various types, and how to get one. Let’s get to it:

What Is a Crypto Credit Card?

Overview of Crypto Credit Cards

Crypto credit cards are payment cards that let users earn crypto rewards when they make transactions instead of points or cash back like a traditional credit card. Users can carry out the purchases they want over the billing cycle and simply pay off the card at the end depending on the agreed terms.

Mostly, you’ll find that crypto credit cards are co-branded credit cards. What this means is that a bank will issue them, but then they will be marketed by a brand like a crypto exchange or investment company.

For instance, the BlockFi Rewards Visa Signature Credit Card is marketed by BlockFi and provided by Evolve Bank & Trust. Hence, you can access rewards via your BlockFi account when you get them.

What Is the Functionality of Crypto Credit Cards?

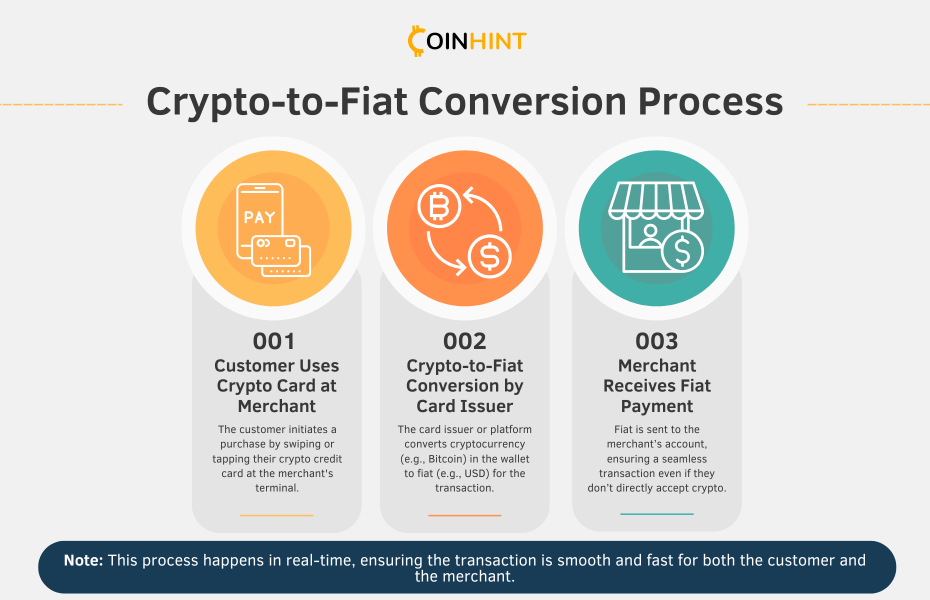

These cards connect crypto and traditional banking. At the point of sale, the card transforms the crypto the card owner possesses into a corresponding fiat currency relevant to the merchant, like EUR or USD. Typically, this is done by the card issuer or crypto platform to enable smooth transfer to the merchant.

How Does a Crypto Pay Card Work?

The crypto credit card behaves like an ordinary credit card; hence, the cardholder can earn rewards when spending using the card. This time, however, the rewards are given in crypto.

The crypto bonus given will also depend on the card provider and the cardholder’s preference for a particular cryptocurrency. A list of acceptable cryptocurrencies is usually provided, and these cryptocurrencies may typically be Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), and Gemini Dollar (GUSD).

The amount of cryptocurrency that enters the user’s wallet is contingent upon the applicable reward rates of the user’s card and the crypto’s value in the market. In most cases, a flat rate will be given to the users for all purchases, with an additional bonus for certain categorized spends.

Types of Crypto Credit Cards

Custodial vs Non-Custodial Cards

Custodial cards impose on users a condition that they deposit their funds in a crypto wallet belonging to the company issuing the card. In turn, they will convert the cryptocurrencies into fiat money during the transactions.

Non-custodial cards, on the other hand, provide an edge to the user, allowing them to link the crypto directly to their wallet. Hence, the user can directly transact with their funds without them being transferred to any third-party wallet.

Visa and Mastercard Crypto Credit Cards

Visa and Mastercard are among the leading payment brands that offer numerous crypto credit cards. Visa provides its crypto credit cards through collaborations with crypto exchange companies and platforms such as Binance, Crypto.com, and Coinbase. Notably, Visa handles the crypto-to-fiat conversion of cards.

Meanwhile, Mastercard focuses on issuing crypto credit cards in partnership with platforms like Gemini and Bitpay. Thanks to their vast network, nearly every country that accepts Mastercard will welcome users to spend crypto in those regions.

Benefits of Using a Crypto Credit Card

Earn Rewards in Crypto

Crypto credit cards let you earn rewards in crypto rather than regular points or cash back. When you use the card, you get rewards in cryptocurrencies such as ETH and BTC. This gives you a chance to build up your crypto holdings through everyday purchases.

Seamless Conversion from Crypto to Fiat

These cards have instant crypto-to-fiat conversion. At the point of sale, the issuer handles all conversion steps, so users don’t have to manage separate transactions or worry about complex conversions. The process is convenient for those seeking to use crypto for real-world transactions, even if the merchant does not directly accept crypto.

Security and Privacy Features

Utilizing strong security measures, crypto credit cards protect user funds and data. Features like two-factor authentication (2FA), encrypted wallets, and fraud protection help secure users’ assets. The enhanced security makes such cards a safe option for digital currency spending, especially for users concerned with security and privacy.

How to Use a Crypto Credit Card Step-by-Step

- Choose the right crypto credit card: First, research different crypto credit cards by looking at their pricing, benefits, functionalities, and the crypto they offer. User ratings will also be helpful.

- Apply for the card: Just like any credit card, one has to complete the application request the card provider gives. Notably, you may also be required to undergo a KYC process.

- Link your crypto wallet: If your card allows, attach your already-owned digital currency wallet to the card. Some cards, however, may require you to keep some money in a wallet owned by the card issuer.

- Make purchases: Now, you can use the card for transactions in your daily purchases, like shopping or gas.

- Earn rewards: After making purchases, check your rewards balance. Depending on the card, rewards may arrive instantly or appear at the end of the billing cycle.

How to Apply for a Crypto Credit Card

Eligibility Criteria

You may have to meet certain criteria when applying for a crypto credit card. Some of the requirements are:

- Age: Most of the time applicants are required to be 18 years old and above.

- Credit Score: Usually, a good to excellent credit score is needed. Some cards state the minimum score required for approval.

- Identity Verification: Most issuers will need KYC (Know Your Customer) documents, which may involve submitting government IDs and proof of residence.

- Income Verification: Some providers will also require income verification as an additional process.

- Crypto Holdings: Certain cards, especially those that offer higher rewards or benefits, may require you to hold specific cryptocurrencies or stake tokens associated with the card issuer.

Top Providers Offering Crypto Credit Cards

Several companies are employing creative solutions to benefit crypto users. For instance, Gemini has a Gemini Credit Card that earns users crypto cash back on every transaction, with no extra costs.

BlockFi’s Visa® Signature Credit Card offers an enhanced reward category and gives BlockFi Rewards for every purchase, with no annual fees.

Meanwhile, Coinbase offers users a Coinbase Card, which allows them to earn up to 4% back in many cryptocurrencies.

At Crypto.com, a crypto-centric company, customers utilize a tiered system of Visa Card that gives them crypto cash back and other features such as travel insurance for the customers.

Risks and Considerations

Volatility of Crypto Prices

Given the fact that the prices of cryptocurrencies can change within a short period, a user’s asset value can diminish between the time of buying and the time of converting to fiat. Such volatility can impact the cardholder’s ability to spend their funds.

Transaction Fees and Exchange Rates

Transaction charges and the conversion rates that the credit card users’ card provider will use in changing crypto to traditional money are other factors that the users need to consider. Most card providers offer a fee for every transaction made, which usually depends on the platform and the type of crypto used.

Top 5 Crypto Credit Cards in 2024

Top Crypto Credit Card Providers

| Provider | Card Name | Rewards | Annual Fee | Unique Features |

|---|---|---|---|---|

| Venmo | Venmo Credit Card | Up to 3% cash back (tiered system) | No annual fee | Integrated with Venmo app for social financial transactions |

| BlockFi | BlockFi Credit Card | 1.5% back in Bitcoin on all transactions | No annual fee | Bitcoin rewards deposited monthly |

| Brex | Brex Business Card | 7x points on travel and food expenses | No annual fee | No personal guarantee required; rewards tailored for startups |

| Nexo | Nexo Card | Up to 2% cash back in Bitcoin or NEXO tokens | No annual fee | Instant rewards; integrates with Gemini app |

| Gemini | Gemini Credit Card | Up to 3% crypto cash back | No annual fee | Instant rewards; integrates with Gemini app |

Venmo Credit Card

Supported by Synchrony Bank, it operates on an enhanced card management platform compatible with the Venmo app for social financial transactions.

The card does not impose a yearly fee and comes with a tiered cash-back rewards scheme. Cardholders can earn up to a 3% cash back in their highest spending category, 2% in their second spending category, and 1% on all other purchases.

BlockFi Credit Card

The BlockFi Credit Card is for consumers who are passionate about cryptocurrency and want to earn Bitcoin in daily purchases.

This card lets its users earn 1.5% back in Bitcoin on all transactions, with the purchases returning on monthly cycles to the users’ BlockFi accounts. This card charges no annual fee, making it friendly for crypto novices.

Brex Business Card

The Brex Business Card targets startups and businesses by offering an attractive business expense rewards program. In contrast to standard credit cards, which often ask for a personal guarantee or undergo a credit history check, Brex evaluates applicants based on their business financials.

This card earns 7x points on certain categories, such as travel and food, making it ideal for businesses that incur high costs in such categories.

Nexo Card

Nexo card allows its users to use their digital currency without necessarily converting it first into fiat currency. This offers a new way of utilizing funds without disposing of assets.

They can also borrow against their crypto assets at very attractive interest rates and use the card for daily transactions, which earns them up to 2 percent cash back in Bitcoin or NEXO tokens. This card is multi-currency and allows a limited number of free ATM withdrawals in a month.

Gemini Credit Card

The Gemini Credit Card provides cash-back of up to 3% on several purchases made with Bitcoin or any other supported cryptocurrency on the Gemini exchange. This card incorporates features of the Gemini app so users can spend their cryptocurrencies and manage their portfolios at the same time.

There is no annual fee, and the rewards earned are instantly credited to the card user’s account after every purchase.

Conclusion

Cryptocurrency credit cards allow digital currencies to be used for everyday expenditures. Best of all, they combine the benefits of both crypto and traditional currency. They offer the convenience of cryptocurrencies and the use of conventional payment systems.

While they offer special rewards and are easy to use, one must be cautious of potential issues such as price volatility and transaction charges. This is why our CoinHint team urges crypto holders to plan carefully and perform thorough due diligence before getting a crypto credit card so they can make the most of their crypto assets for daily purchases.

FAQs

-

Is it worth having a crypto credit card?

Yes. A crypto credit card is worthwhile for those looking to use crypto for everyday transactions. These cards tend to provide cashback or rewards in the form of cryptocurrencies, thus increasing the value of purchases. Moreover, they act as an alternative means to utilize cryptocurrencies, other than converting them into fiat currency prior to any usage.

-

Can I withdraw money from a crypto credit card?

Yes, you can withdraw money from a crypto credit card, but the method depends on the card issuer, card usage, and features. Most crypto credit cards allow users to withdraw cash from ATMs that accept Visa or Mastercard. However, it’s important to note that fees may apply, especially if you exceed the fee-free withdrawal limits.

-

What is the limit on a crypto debit card?

The limitations on a prepaid crypto debit card vary according to the card issuer and the tier of the card in question. For example, certain cards permit users to withdraw €200 monthly for cards in the lower level, while cards higher up the pyramid may have limits of €1000 and above. In addition, most issuers set up a daily withdrawal limit, which varies between €200 and €5000 depending on the card’s features and the user’s verification.

-

What is the difference between a crypto credit card and a crypto debit card?

A crypto credit card is just like any other credit card in that it allows a customer to spend up to a set amount and then return the borrowed funds later, typically with fees added on for failing to repay the total amount within a given period. On the other hand, a crypto debit card is associated with the owner’s crypto wallet or account, allowing the owner to use only the amount available in that particular account without going into debt.