What Is DeFi Insurance and How Does It Work?

Unlike most mainstream sectors, the crypto arena is not adequately covered by traditional insurance firms and policies. This is due to the volatility of the space, the risks involved in providing crypto-related insurance, and the difficulty in tracking these risks. Meanwhile, traditional insurance solutions are frequently found lacking in accessibility, reliability, and overall user experience. DeFi Insurance projects attempt to provide adequate insurance solutions for cryptocurrency investors while fixing the pain points experienced by traditional insurance platform users. In this article, we discuss DeFi insurance, how it works, and what it means for cryptocurrency investors.

An Overview of DeFi Insurance

DeFi insurance is also known as decentralized insurance or crypto insurance. It defines protocols based on the blockchain that use decentralized protocols to engineer functional insurance policies against crypto-related risks and common real-world risks. DeFi insurance is a section of decentralized finance that focuses on minimizing common losses through full or partial compensation using protocols deployed on a blockchain.

Why Is DeFi Insurance Important?

- DeFi insurance is permissionless and therefore more accessible to institutions and regular individuals

- They are self-operating, making for greater accuracy and responsiveness.

- They cover crypto-related risks that are often neglected by mainstream insurance firms.

- DeFi insurance scales the adoption of blockchain technology by applying it in a very important sector.

- DeFi insurance also reduces false claims by using independent sources and decentralized oracles to feed the protocol with information regarding events and claims.

The Growth of DeFi Insurance

At the time of writing, projects in the crypto insurance category control a market cap of over $360M. Due to the increase in mishaps in the crypto space, often neglected by mainstream insurance firms, DeFi insurance projects have enjoyed exponential growth. Nexus Mutual, the largest DeFi insurance protocol has a total value locked (TVL) of over $200M, this is primarily premiums in crypto locked up in the platform. Other projects in this category have seen significant growth in the last four years with projects like inSure DeFi, Cover protocol, Vaiot, and Uno Re growing through the ranks. The headcount of projects in this category has also grown during this time.

Despite being a relatively young concept, crypto investors are exploring risk-management opportunities presented by decentralized insurance protocols. DeFi insurance protocols have also advanced in terms of risk coverage. From risks related to DeFi platforms, many decentralized insurance protocols have expanded to real-world risks and risks related to custodial institutions.

How Does DeFi Insurance Work?

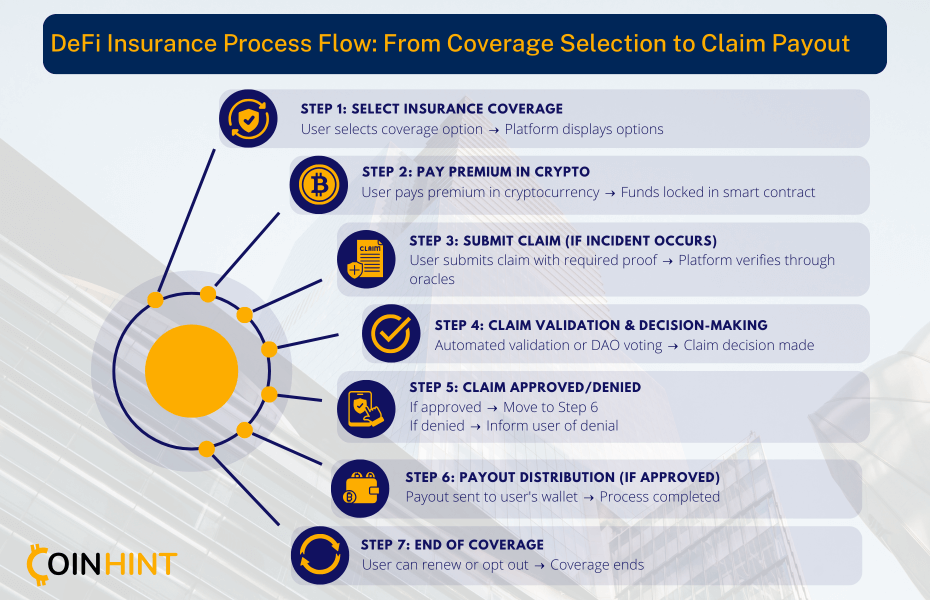

DeFi Insurance platforms adopt the basic operation mechanics of traditional insurance – pay reimbursements to policyholders who file a successful claim. However, they differ in the underlying technology and decision-making procedure. Here are the basics of DeFi Insurance.

The Basics of DeFi Insurance Mechanisms

DeFi insurance makes more use of parameters, automation, and decentralized decision-making.

First, the insurance provider presents a catalog of insurance coverages. This specifies the risk covered and the premium paid for each plan. Interested users pay for the coverage and submit the required information. Payment is usually made in selected types of crypto assets. Some DeFi Insurance platforms also require KYC verification.

DeFi insurance platforms are equipped with oracles that feed the protocol with external information, however, in case the covered mishap occurs, affected users are expected to submit requested data surrounding the event and their claims. Using the coded parameters, the protocol reviews the claim and decides a payout. Some DeFi insurance platforms decide the validity of a claim via DAO voting. Users will be able to claim their payout when the decision process is completed.

Common Types of DeFi Insurance Coverage

Smart Contract Vulnerability Coverage

Smart contract codes are designed to handle various kinds and amounts of assets. Even small malfunctions in the smart contract operation could lead to tangible losses for users. To provide a means to reduce or cover losses in case of technical exploitation, smart contract developers can insure their protocols using decentralized insurance policies. DeFi insurance projects like Uno Re have specific insurance policies for smart contracts.

Protocol Failure Coverage

DeFi protocols allow users to access financial services through self-custody options. However, they are vulnerable to attacks and operational challenges, most times leading to tangible losses for the users. DeFi Insurance projects like Nexus Mutual allow protocol users to subscribe to an insurance plan for specific decentralized failures. Projects like Aave, Curve, GMX, and Uniswap, are featured in Nexus Mutual’s protocol failure coverage plans. Users of these protocols can purchase an insurance plan for the funds held in these protocols, in case they suffer a mishap.

Custodial Insurance Coverage

Custodial insurance coverage provides indemnity for users of custodial financial institutions that offer crypto services. Institutions like crypto exchanges, centralized crypto lenders, and other related institutions hold funds on behalf of their users. Users risk losing these funds if the institution falls victim to hacks. DeFi Insurance protocols with active custodial insurance coverage enable users to insure their assets held in custodial institutions. For instance, Nexus Mutual has Custodial Insurance coverage for Binance and Coinbase Exchange.

DeFi Insurance Coverage Breakdown

| Coverage Type | Description | Example Platforms |

|---|---|---|

| Smart Contract Vulnerability Coverage | Insures against risks related to smart contract failures or exploits, where bugs in code can result in losses for users. | Uno Re, Nexus Mutual |

| Protocol Failure Coverage | Protects users from losses if a decentralized protocol (such as a lending platform or exchange) experiences a failure or is compromised. | Nexus Mutual, Cover Protocol |

| Custodial Insurance Coverage | Covers risks associated with custodial institutions, such as exchanges or centralized platforms, in case of hacks or failures resulting in asset loss. | Nexus Mutual (Binance, Coinbase) |

Benefits of DeFi Insurance

DeFi insurance is a handy concept, especially for crypto and blockchain enthusiasts. Even for individuals outside the crypto space, it offers a couple of benefits. Some of these benefits include:

Protecting Against Smart Contract Risks

Many smart contract programming languages are yet to evolve to adequately tackle several code-level security risks. In addition, smart contract engineers are vulnerable to making mistakes that could compromise security. While the expectations for smart contracts are expanding, risk management practices are evolving at a slower pace. Therefore, an external risk-management option is important. Only DeFi insurance projects provide this coverage to date. Developers and project teams can curb their potential losses in smart contract vulnerabilities by adopting an insurance plan. This way, DeFi Insurance protocols enable developers to innovate with less worry about the risks associated with vulnerabilities.

Enhancing Trust and Security in DeFi

Like other financial spaces, DeFi transactions involve the movement and management of funds. Users are always in a dilemma when using any financial platform. By providing an avenue to insure against risks, DeFi Insurance projects enhance financial security for DeFi enthusiasts. Projects with functional DeFi insurance coverage also improve the trust level of investors who interact with their projects. In general, it expands the safety scope for decentralized finance.

Coverage Customization for Users

DeFi insurance policies are also flexible, users are presented with a wide range of options and the freedom to subscribe to a plan that suits them and the risks that apply to them. Users also have the freedom to adjust the policies to a good extent. The reduced rigidity of DeFi insurance policies also improved users’ experience.

Risks and Challenges of DeFi Insurance

Amidst the various benefits of DeFi insurance, our Coinhint analysts caution that this evolving area faces several challenges and limitations, including:

Smart Contract Risks and Vulnerabilities

Like the protocols for which DeFi insurance projects provide risk coverage, they are also built using blockchain primitives and make extensive use of smart contracts. As a result, they face the same level of risks as other smart contract protocols. In case of malfunctioning of the underlying smart contracts, users of decentralized insurance platforms could also run into significant losses.

Regulatory Uncertainty in the DeFi Space

The legal jurisdiction for DeFi projects is currently unclear. The recent legal friction between Ethereum DEX– Uniswap and the SEC further complicates the position of central government agencies on self-custody financial service providers, DeFi insurance falls into this category. While users would expect fewer regulatory interactions with such platforms, this might not be the case as the legal boundaries are not clearly defined. As the regulatory grounds for DeFi projects evolve, DeFi Insurance platforms could be subject to laws that limit their usage or lead to bans in key regions.

Liquidity and Payout Issues

DeFi Insurance is still an emerging concept. As a result, most decentralized insurance protocols are still growing their user base. Due to a relatively small number of users, several DeFi Insurance platforms suffer from low liquidity. Low liquidity means a shallow pool of resources from which indemnities are paid. In some cases, this could cause delays in payout, and other inconveniences that reduce the quality of the user experience on the concerned platform.

How to Choose the Right DeFi Insurance for You

Before choosing a DeFi Insurance provider or coverage, here are some points to consider

- Ensure that the insurance provider is reputable

- Evaluate liquidity conditions: Check the TVL on each platform to ascertain financial sufficiency for core insurance operations.

- Review available coverages: Check the insurance policies on the platform to identify ones that apply to you and the terms of each of them.

- Assess claim parameters and payout procedure: Review the conditions for a claim, eligibility criteria for full or partial reimbursement, and how the platform makes payment.

Compare with close options: Compare available DeFi insurance for the factors discussed earlier and select the best option.

Defining the Future of DeFi Insurance

DeFi Insurance is an emerging concept. Despite being at a very early stage of growth projects in the sector have grown exponentially in the past four years in terms of technological advancement, coverage options, and quality of services. Going into the future, here are some innovations and trends to watch for Defi insurance projects.

Innovations and Trends to Watch for DeFi Insurance Project

Increased Coverage for Real-World Incidents

Contemporary DeFi insurance platforms offer coverage mainly for crypto-related risks. This could change in the future and coverage for trackable real-life incidents like flight cancellations and natural disasters could be possible on DeFi insurance platforms. Technologies like oracles could help in data management for such coverages.

Liquidity Solutions Based on Passive Income Programs

To improve the availability of funds for insurance indemnity and other associated uses, DeFi insurance projects could pivot towards sourcing for platform liquidity using strategies similar to those implemented by other DeFi platforms. Introducing passive income programs for liquidity providers as seen on DeFi lending platforms could be a feature on DeFi insurance platforms.

Tradable Insurance Policies

Another trend that could emerge in the future for DeFi insurance is tokenized and tradable insurance policies. Insurance policyholders might be able to trade their policies like NFTs in the future.

Conclusion

Decentralized insurance solutions attempt to tackle another sector dominated by traditional institutions. Not only do they cover the crypto space – a sector usually neglected by traditional insurance firms, but they also provide effective self-operating, and accessible solutions to real-world risk insurance. In the course of this article, we discussed DeFi insurance, how it works, and what it means for anyone looking to leverage these solutions. This category is dominated by projects in their early stage, as DeFi insurance as a concept is a relatively young concept. Therefore, it is important to conduct proper research before subscribing to any DeFi insurance. Ensure that the provider is trustworthy, and you understand the core of the policy.

FAQs

-

Is DeFi insurance reliable and easy to process?

Decentralized insurance policies are relatively easier to access than traditional insurance policies. This is because they are permissionless and automated. Thanks to blockchain-level security architecture, they are also considerably more reliable.

-

What is DeFi insurance and how does it differ from traditional insurance?

DeFi Insurance uses decentralized platforms and protocols to encode insurance policies, subscriptions, and claims. It is different from traditional insurance in its underlying technologies and accessibility. DeFi insurance is decentralized, permissionless, and self-operating.

-

What are the most common risks covered by DeFi insurance?

Common risks covered by DeFi insurance include risks related to crypto investments, smart contract vulnerability, scams, and asset devaluation. Decentralized insurance protocols also cover real-world risks like geographical mishaps and flight delays.

-

What should I consider before choosing a DeFi insurance provider?

Before getting DeFi insurance, consider the reputation of the policy provider and ensure that the policy contracts are vetted by a trustworthy auditor. Also consider the policies, rates, and parameters for claims to ensure that they are feasible and beneficial for you.